Lars Thomsen, futurologist and member of the Board of Directors at Juice, outlines the key factors which will affect the acceptance of electric vehicles in markets in the DACH region in the coming years

Juice Technology AG, manufacturer of charging stations and software, leader in mobile charging stations for electric vehicles, and futurologist Lars Thomsen provide insight into the most important trends which will affect the development of electromobility in Germany, Austria and Switzerland in the coming years.

In December 2019, the EU declared that it wants to reduce greenhouse gas emissions from traffic by 90 percent in comparison with 1990 by 2050. In order to meet this target, which is part of the European Green Deal, efficient charging infrastructure for electric vehicles needs to be built, among other things. Sufficient charging capacity for passenger vehicles and lorries should therefore be built every 60 km in each direction along the Trans European Network – Transport (TEN-T) by 2030. Although the target of a million charging points by 2025 seems very ambitious, it is no less than is necessary in light of the rapid development of electromobility.

Status quo – where is Europe now when it comes to e-mobility?

In 2021, the proportion of electric vehicles in Europe was around 20% of new car sales. The market share for electric vehicles (including BEV, PHEV and hybrid) rose from 8% in 2019 to 38% in 2021 in the five biggest European markets (France, Germany, Italy, Spain and Great Britain). A purely electric vehicle was the best-selling vehicle in Europe (with regard to all drive types) for the first time in September 2021 with the Tesla Model 3. While the market for diesel and petrol drives is in decline according to registrations, the proportion of “plug-in vehicles” has been seeing double-digit growth for some time.

The proportion of electrified vehicles (BEV and PHEV) will thus exceed new registrations of diesel and petrol vehicles in Europe in the first half of 2023. By 2025, electric vehicles will reach the tipping point at which they become significantly more attractive than the outdated combustion engine models both economically and in direct performance comparisons in practically all vehicle segments and classes. Ranges are increasing,

while charging times are coming down ever more sharply and charging options in public and private spaces are becoming more and more a matter of course. Thanks to increasing competition, falling prices and a wide range, these vehicles will also become increasingly dominant in the high-volume moderate and low

price segment.

China leads the way in BEVs and the USA trails behind

China has reached the point at which it is able to enter the European and US markets with new (very attractive) electric vehicles and PHEVs and stand out. Lars Thomsen expects that there will be at least six Chinese brands with multiple models in both markets by 2025. At the same time, this provides a further boost for the US market for electric vehicles,

which was expanding rapidly anyway (+190% compared to the previous year). China will remain the largest BEV market in the world until 2026.

The US market is anticipating a boost for EVs and for charging infrastructure beyond the previous hotspots in the metropolitan regions. In particular, the simultaneous entry of multiple players into the key US car market with “pickup trucks” will facilitate a jump of more than 15% in new registrations in the USA from the middle of 2022. Depending on the availability of batteries and vehicles, the proportion of EVs among new car sales will rise to at least 40% by 2025, even in the USA. In the same period, the volume of EV charging technology on the US market could increase twenty-fold in comparison with today.

Development of charging infrastructure in Europe

Multiple trends are emerging simultaneously in charging infrastructure:

- The three-phase 11 kW charging device is winning out as the most common solution for AC charging in Europe: On the vehicle side, this size of on-board charger is easy to install and is sufficient to fully charge even batteries of 80 kWh or more overnight.

- In the DC sector, the CCS connection with a charging capacity of up to 350 kW is the standard along long-distance routes. 50 to 100 kW installation are used in public car parks etc. in cities or at points of interest.

- By 2024, practically every motorway services in Europe will have fast charging connections, which means enormous investments for the operators. These will be passed on to the user in the form of very high prices per kWh unless users conclude a premium contract with the appropriate operator with a monthly basic fee. According to current forecasts, three to five networks will take shape across Europe which, similarly to mobile operators today, will compete for long-term customer loyalty.

Europe is challenged to help to shape the rapid transition to sustainable, electric mobility actively and with resolve. This new dynamic will reshuffle the cards in the automotive industry at a global level.

Christoph Erni, CEO and founder of Juice Technology AG is convinced: “Now more than ever, there is an opportunity for technology centres like Germany, Austria or Switzerland in particular to accelerate the transport revolution through innovation and to incorporate mobility into a new green economy.”

Electric vehicles and intelligent, high-performance and suitable mains charging infrastructure go together like two sides of the same coin. Throughout Europe, we need equal and good conditions so that we are able to continue taking a leading role in global e-mobility and meet the necessary climate targets which we have set for ourselves.

Particularly against the backdrop of current developments, everyone must be clear that locally and regionally generated renewable energy is superior to any finite and contested finite resource.

---

JUICE WORLD

More information about Juice at www.juice-world.com

About Juice Technology

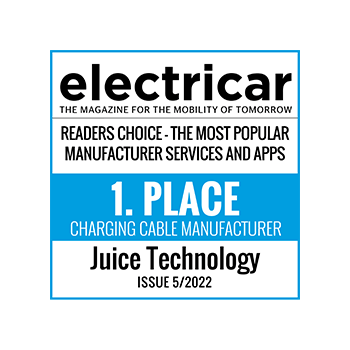

Juice Technology AG, with its headquarters in Bachenbülach (near Zurich airport, Switzerland), is a globally active manufacturer of charging solutions for electric vehicles. The company’s extensive product portfolio, with AC and DC charging stations ranging from light mobile devices through to large fast chargers, makes it one of a very small number of full-range providers in the industry. Juice has dominated the market in mobile 22 kW charging stations since 2014.

The crucial difference to other solutions available on the market is the consistent software orientation. All devices designated “j+” are based on the same processor and the same firmware, which means they are compatible with one another. Juice saves on time, effort and costs by using its own consistent software architecture. Solutions such as omni-dynamic load management, payment by credit card or the open interface backend are therefore available throughout the product range.

The Juice Group has global reach with its own sites, subsidiaries and affiliates. Juice Services AG, Juice Telemetrics AG, Juice Europe GmbH in Germany with a subsidiary in Munich, Juice UK and Ireland Ltd in London, Juice Nordics AB in Uppsala, Juice Iberia S.L. in Malaga, Juice France SAS in Paris, Zhejiang Juice Technology Co., Ltd in Hangzhou, China and Juice Americas Inc. in St. Petersburg, FL, USA are part of the group of companies. It also has a global network of resellers. More than 200 people currently work in the research and development, production, marketing, administration, purchasing and sales, and logistics departments.

You can find more information about the company, the products and solutions at www.juice-world.com. You can also follow us on LinkedIn, Facebook, Instagram and Twitter.

Media contact

Daniela Märkl

Communication & Public Relations

Juice Technology AG

maerkl@juice-technology.com

+41-41 510 02 19 or +49-800 3400 600